Backed by the famous entrepreneur Richard Branson, Lightyear is a new online brokerage that has been growing a lot in Europe. It has a slick and modern app, a good range of products to invest – mostly stocks, ETFs, and interest – and very low fees!

All in all, it looks like a great alternative for beginner investors who want to buy-and-hold or benefit from the interest offered.

On the downside, it lacks some products that professional investors might value, such as options trading, bonds, and crypto.

Want to know more about Lightyear? Keep reading, we’ve got you covered!

Lightyear Overview

As we mentioned in the introduction to this article, although it is a new platform, lots of investors are interested in the Lightyear trading platform. Lightyear has a website and app that are perfect for investing in its more than 6,000 stocks, ETFs and money market funds. Best of all, every month the platform is adding new products, so you can add new investments to your portfolio.

Another aspect to highlight of this platform is that the costs are low, if we compare them with other competitors (especially if we do it with the big companies in this market).

Since October 1st, 2025, Lightyear stopped offering interest on uninvested cash in most countries where it operates (the alternative is to earn interest by investing in Money Market Funds (MMFs). Still, if you are a resident in Ireland, Hungary or the United Kingdom (UK), you continue to earn interest on your parked cash.

Below is a table where you will find all the general information about Lightyear:

| Country of regulation | UK and Estonia |

| US stocks fee | 0.1%, max $1 per trade |

| EU stocks fee | €1 |

| UK stocks fee | £1 |

| ETFs fees | Free (other fees may apply) |

| Market money funds | From 0.09% to 0.3% |

| Inactivity fee | No |

| Deposit fee | $0 for transfers (0.6% debit card, Apple Pay and Google Pay) |

| Withdrawal fee | No |

| Minimum deposit | $0/€0/£0 |

| Available base currencies | USD, EUR, GBP, HUF |

| FX fees | 0.35% |

| Demo account | No |

| Products offered | Stocks, ETFs, money market funds |

Pros and cons

After doing extensive research on Lightyear, here are its strengths and weaknesses:

Pros

- The user experience on the platform is very good.

- Lightyear app is a perfect way to invest easily and quickly from your phone.

- Very low fees compared to competitors.

- You can invest in US fractional stocks.

- All stocks have in-depth analysis and expert analysis.

- Transparency in the fees charged

- Backed by reputable investors such as Richard Branson

Cons

- No advanced features for more experienced investors.

- The offer is not very large compared to other platforms. For instance, other brokers also have CFDs, crypto, commodities or options.

- There is no demo account.

Fees

One aspect we like about Lightyear is that it is transparent with the fees it charges. Also, these are some of the lowest on the market at the moment. And, if you don’t have the currencies that the platform accepts (USD, EUR, GBP, HUF), the currency conversion fee is 0.35%.

Another aspect we would like to mention is that there are no deposit and withdrawal fees when investing in ETFs.

Also, as far as the minimum deposit is concerned, it is non-existent. This is very positive, as similar platforms tend to ask for large amounts to get started (1,000 € or more), which means that many potential investors do not end up using the broker.

All in all, Lightyear is one of the cheapest stock trading platforms on the market, which may appeal to beginner investors. Below is a table showing Lightyear’s main costs:

| Monthly platform fees | No |

| US stocks fee | 0.1%, max $1 per trade |

| EU stocks fee | €1 |

| UK stocks fee | £1 |

| ETFs fees | Free (other fees may apply) |

| Market money funds | From 0.09% to 0.3% |

| Inactivity fee | No |

| Deposit fee | $0 (0.6% for debit card, Apple Pay and Google Pay) |

| Withdrawal fee | No |

| FX fees | 0.35% |

Range of Products

The platform has several products to invest in. Although their offer is not one of the largest at the moment, it is true that they are constantly adding new products, so their portfolio is getting bigger and bigger, with more Lightyear trading options. Below, we explain the products offered:

Stocks

Lightyear has more than 3,000 shares of companies from countries such as the USA, the European Union and the UK. They are expanding their offer, and it is now possible to invest in stocks of Chinese companies such as Alibaba, Baidu or HSBC. Also, you can invest in stocks from Canadian companies.

Whenever you are looking for a stock, there is plenty of information to help you make a well-informed decision before investing like news, price history or the performance of the company. In addition, there is also expert analysis.

| US stocks | 5300+ from NASDAQ and NYSE |

| EU stocks | 100+ mainly from Germany, France, Belgium and the Netherlands |

| UK stocks | 50+ |

| Asia stocks | 40+ |

| Canada stocks | 100+ |

Fractional stocks

The platform also gives you the possibility to buy fractional shares of US companies, which is ideal for expensive stocks. For example, at the time of writing, Amazon shares are worth more than $160. If you only invest $50, you can get a portion of that.

ETFs

ETFs (exchange-traded funds) are a collection of many investments that are bundled together in one place, making the investment more accessible than if you had to buy each one separately. This is why it is such a popular product.

There are currently more than 300 ETFs on Lightyear. For example, you can invest in FTSE 100 ETFs or S&P 500 ETFs, but there are also thematic ETFs, such as technology companies.

| ETFs | 300+ worldwide |

Money market funds

You can invest in money market funds. These allow you to invest in large short-term government and institutional bond baskets. The fees range from 0.09% to 0.3%. The best thing is that you don’t need much money to invest, so it’s a perfect product for beginners.

Money market funds specialize in investing in highly liquid short-term debt instruments, prioritizing a high level of liquidity. Unlike ETFs, which are actively traded on the stock exchange, money market funds follow a different rhythm and trade once a day. Lightyear aims to make this low-cost investment option easily accessible to everyone, regardless of the level of investment experience.

Lightyear trading platforms

One of the great advantages of the Lightyear investment platform is that it offers the possibility to invest from the web and the mobile application. Let’s take a closer look at the experience on both in more detail below.

Lightyear app review

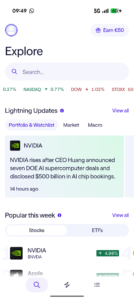

What becomes clear once you open the Lightyear app is the platform’s commitment to it. We won’t fool you if we say that this is one of the best apps on the market. The user interface is very good, and the information is presented in a way that does not overwhelm, which is always very important.

For example, on the explore page, you can easily see the search bar, which is the tool you should use to search for stocks or any product you want to invest in.

On this page you also have information about the latest stock news, the most popular stock and ETF selection of the week or a thematic list of stocks and ETFs in case you are interested in investing in them.

The portfolio page shows a graph with the current value of your portfolio. On this, there is a breakdown of your investments, plus the cash (unused money you have on the platform) and the interest you are earning. Best of all, the information is displayed in a very intuitive way.

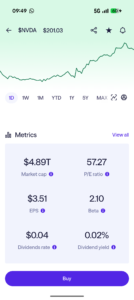

Each stock of a company you are looking for is presented with a lot of information, such as its market capitalisation, earnings, expert analysis, analyst ratings, price history, and whether it pays dividends.

For all the information it offers, at first glance it doesn’t bother you, as they take great care in the presentation, making it easy to navigate through it. Some brokerage applications can become too much with all the information displayed on small screens. However, the Lightyear app feels completely different, as it is presented in a way that does not overwhelm the screen.

Each stock page has a “Buy” button that is clearly displayed at the bottom of the screen. When you click, you can indicate either the number of shares you want to buy or the amount of money you want to invest (remember that in the case of the US there are fractional stocks). On the buy page, you have functions such as:

- Market order: you buy the stock at the best available price when the market opens:

- Repeat order: you can set up a recurring purchase of stocks you are interested in.

- Limit order: you automatically buy a stock when it reaches the price you decided earlier.

- Stop order: you set the price of a stock and, when it reaches this price, you can automatically sell or buy it.

All in all, the Lightyear app is very intuitive and easy to use, which makes it perfect for beginner investors. The only thing we might miss is a bit more advanced tools, although we don’t rule out the possibility that the platform will include them in the future.

Lightyear trading web

As mentioned, Lightyear has a great Lightyear app. However, they are putting a lot of effort into the platform offered on the website.

For example, from the website, you can select the assets you are most interested in tracking, or in the activity section you can find an extract of the transactions you have.

On the right-hand side, there is a column showing the most viewed assets on the Lightyear trading platform. If you go to the bottom of the page, you will find the Top Stories, where you will find all the most interesting articles and videos from the world of finance.

To search for stocks and other products, you will see a search bar on the top right-hand side. It’s very easy to see it. When you select an asset, you will find very detailed information about it. So you can always invest from a well-informed position.

Lightyear safety

Before choosing any investment platform, one of the most important questions investors ask is: “Is my money safe?” This is particularly relevant for those new to investing or considering a relatively young company like Lightyear.

Regulation and oversight

Lightyear operates under strict financial regulations in both Estonia and the United Kingdom:

- In Europe: Lightyear Europe AS is authorised and supervised by the Estonian Financial Supervision and Resolution Authority (EFSA), under license number 4.1-1/31.

- In the UK: Lightyear Financial Ltd is authorised and regulated by the UK Financial Conduct Authority (FCA).

This dual regulation ensures that Lightyear complies with robust standards for client asset protection, capital adequacy, and operational transparency.

Investor protection schemes

Depending on your country of residence, your assets are covered by different investor protection mechanisms:

- European investors are protected up to €20,000 under the Estonian Investor Protection Sectoral Fund.

- UK investors benefit from protection up to £85,000 through the Financial Services Compensation Scheme (FSCS).

These protections apply if Lightyear were to fail financially, but they do not cover losses from poor investment performance or market downturns.

Safeguarding of client assets

Lightyear keeps client assets completely segregated from its own company funds. This means your money and investments are held in separate, secure accounts and cannot be used for Lightyear’s operational purposes. In the unlikely event of bankruptcy, investors would still retain access to their assets.

Company transparency and track record

Because Lightyear is a private company, it is not required to publicly disclose detailed financial statements as publicly listed brokers must.

Additionally, being a young fintech firm (founded in 2020), Lightyear does not yet have a long track record to assess its resilience during major market or operational stress events. However, its ongoing regulatory compliance and transparent business model inspire growing confidence among its user base.

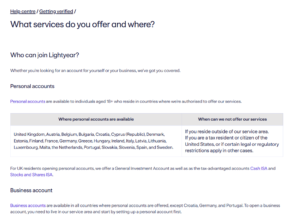

Countries accepted by Lightyear

Being regulated by Estonia, Lightyear operates in a total of 25 countries, 24 of which are in the European Union and the other is the United Kingdom. The company is working to offer its platform to other countries around the world.

How to open a Lightyear account

Next, we are going to explain how you can open an account on the Lightyear investment platform through their website.

Step 1 – Go to Lightyear

Go to the broker’s website and click “Log in”:

Step 2 – Sign up

Next, click on “Sign Up” to register. You will be prompted for an email address and password. On the next screen, after confirming your email address, you will be asked to enter your phone number to send you a 4-digit code.

After confirmation, you need to fill in personal information such as your name, date of birth, address, nationality and email address. It is also necessary to provide your details of your main source of income.

You will then need to verify your identity by presenting your ID card and a selfie.

Step 3 – Make a deposit

Once your account is active, you need to make a deposit to start investing. Generally, opening an account can take up to 2 business days, although Lightyear claims that some users see their account verified in just a few minutes.

Lightyear Promo Code

At the time of writing this review, the platform is offering a promotion with the code FINTECHFINDER to get up to €100 in fractional shares to your Personal Account. Capital at risk. T&C apply. You must be a new user and deposit at least €100. The reward can be withdrawn 6 months after it’s credited. If you are interested in finding out more, feel free to follow the link for more information on the promotion at Lightyear.

What do users say about Lightyear?

Lightyear is a platform much loved by its customers. Here are some of the reviews we have found on Trustpilot.

The bottom line

Lightyear is one of the newest platforms on the market and one of the fastest growing. Although more advanced tools may be lacking for more experienced investors, its intuitive app and the way the information is presented make it perfect for beginners.

In Lightyear, you can invest in stocks (Including fractional shares), ETFs and market money funds. Although its offering may be small compared to established brokers, the company is actually working on adding new products. In addition, their costs are some of the lowest. And, we can assure you, there are no hidden fees.

If you want to try out one of the best platforms now, don’t hesitate to do so with the Lightyear promo code. All in all, Lightyear helps you to invest and track your transactions comfortably.