Backed by a NASDAQ-listed parent company (Freedom Holding Corp., ticker: FRHC) and regulated within the European Union, Freedom24 has emerged as a fast-growing online broker with over 500,000 clients across Europe.

The platform stands out for its broad product offering, giving investors access to more than 40,000 stocks, 3,600+ ETFs, as well as bonds and U.S. stock options. Whether you’re a beginner looking to build a long-term ETF portfolio or an experienced trader seeking diverse instruments, Freedom24 offers a versatile toolkit.

Freedom24’s credibility is further reinforced by its inclusion in the Russell 3000 Index, a benchmark of prominent U.S.-listed companies, and a recent “B+” credit rating upgrade with a stable outlook by S&P Global Ratings.

Of course, it’s not without limitations: some features like automatic tax reporting or free withdrawals still trail behind what top-tier brokers offer.

Curious if Freedom24 is the right platform for you? Read on for a balanced and detailed Freedom24 review.

Freedom24 overview

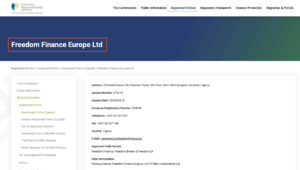

Freedom24 is the trading platform of Freedom Finance Europe Ltd., a subsidiary of Freedom Holding Corp., a publicly traded company listed on the NASDAQ. This corporate structure provides a level of transparency that is uncommon among European brokers. Regulated by CySEC (Cyprus Securities and Exchange Commission), Freedom24 is authorized to serve clients across multiple European countries.

The platform offers direct access to markets in the U.S., Europe, and Asia, allowing investors to trade in stocks, ETFs, bonds, and even U.S. stock options at some of the most competitive rates available.

Additionally, Freedom24 runs promotions for new users, sometimes including a Freedom24 promo code that could provide a Freedom24 bonus in the form of free stocks.

General info about Freedom24:

- Country of regulation: Cyprus (EU) via CySEC

- U.S. stock commissions: From around €0.02 per share + €2 per order (Smart plan)

- ETFs commissions: A Similar low-fee structure, no monthly subscription fee

- Inactivity fee: No

- Withdrawal fee: €7 (per withdrawal)

- Minimum deposit: €0

- Products offered: Stocks, ETFs, bonds, futures, options

- Demo account: Yes (virtual account upon signup)

- Regulatory oversight: CySEC, registered with BaFin, parent listed on NASDAQ

Pros and cons

Pros

- Extensive Product Range: 40,000+ stocks, 3,600+ ETFs, U.S. options, bonds—all under one roof.

- No Monthly Fees & No Inactivity Fees: You won’t pay just for having an account.

- Transparent Ownership & Regulation: Backed by a NASDAQ-listed entity, regulated in the EU, and compliant with MiFID II.

- Potential Freedom24 Bonus: Occasional promotions, such as free shares when using a Freedom24 promo code.

Cons

- €7 Withdrawal Fee: A flat fee per withdrawal is a downer, especially for frequent moves.

- Tax Handling: No automatic tax reporting for certain countries; you must handle taxation yourself.

- Currency Conversion Fees: Around 0.02% spread could add up for frequent cross-currency trades.

Products and markets

Freedom24 provides access to a wide range of investment products across major global markets, with a particular strength in Exchange-Traded Funds (ETFs) — one of the most popular and cost-effective tools for portfolio diversification.

ETF offering: A core strength

Freedom24 stands out for its extensive ETF selection, offering over 3,600 ETFs from top global issuers, including iShares, Vanguard, Invesco, and SPDR. This wide range allows investors to build highly diversified portfolios tailored to different strategies, regions, sectors, and risk profiles. Key categories include:

-

Index ETFs – Track major global and regional indices for broad market exposure at low cost.

-

Dividend ETFs – Focus on high-yield, dividend-paying companies, ideal for income-seeking investors.

-

Bond ETFs – Short- and mid-term sovereign and corporate bond ETFs, offering predictable income in EUR and USD.

-

Thematic and Sector ETFs – Gain exposure to high-growth themes such as clean energy, AI, robotics, or biotech.

-

Covered Call ETFs – Combine equity exposure with option premium income to boost returns.

-

Inverse and Leveraged ETFs – Tools for advanced investors aiming to hedge or amplify specific market views.

Additionally, Freedom24 can add ETFs upon client request, offering flexibility rarely found with other brokers.

Access to global markets

Beyond ETFs, Freedom24 offers trading in a wide range of securities across major international exchanges, including:

-

Stocks – Thousands of individual companies listed on exchanges in the U.S., Europe, and Asia.

-

Bonds – Both government and corporate bonds in multiple currencies.

-

Options – U.S. listed stock options for more advanced trading strategies.

This global reach empowers investors to construct highly diversified, cross-border portfolios through a single platform.

Fees

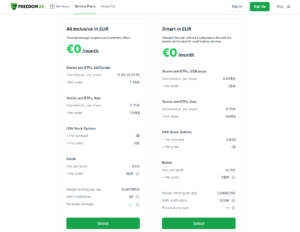

Freedom24’s pricing structure is relatively transparent. There are currently two main “service plans”:

- All inclusive in EUR: Another choice, with a personal manager. This personal manager offers tailored assistance for all needs, from technical support to customised investment advice, aligned with the client’s goals, planning horizon, and risk tolerance.

- Smart in EUR: Ideal for regular retail investors. Stocks and ETFs from the U.S. and EU often cost €0.02 per share + €2/order; U.S. options are $0.65 per contract, which is highly competitive. No monthly fee.

Keep an eye on other costs:

- Withdrawal: €7 flat fee.

- Currency conversion: Approximately 0.02% spread.

- No inactivity fee: A plus for long-term investors.

In terms of transparency and fairness, Freedom24 fees are decent. Still, if you plan to withdraw frequently or trade multiple currencies, costs can add up.

Is Freedom24 safe? Is Freedom24 a scam?

It’s a fair and important question for any investor: Is Freedom24 safe to use?

The answer is yes — Freedom24 is a regulated, transparent, and well-established broker, not a scam. Here’s why:

1. Regulated under European law

Freedom24 operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC) and complies fully with the MiFID II directive — the cornerstone of investor protection across the European Union. This regulatory framework imposes strict requirements on how client assets are managed and how the broker conducts its business.

Freedom24 has been licensed and active since 2015, with a clean operational record and ongoing oversight from the EU and national financial regulators.

2. Segregated client funds & compensation coverage

In line with MiFID II and ESMA rules, Freedom24 holds all client funds in segregated bank accounts, meaning your money is kept separate from the broker’s own capital. This structure ensures that your funds are protected even in the event of corporate insolvency.

Additionally, Freedom24 is a member of the Investor Compensation Fund (ICF) in Cyprus. In the unlikely event that the company becomes insolvent, eligible retail clients are covered for up to €20,000 in compensation, providing an additional layer of financial security.

3. Publicly listed parent company

Freedom24 is the European arm of Freedom Holding Corp. (FRHC), a U.S.-registered company listed on the NASDAQ stock exchange and regulated by the U.S. Securities and Exchange Commission (SEC). As of July 2025, the group had a market capitalisation exceeding $8 billion.

Being part of a publicly traded company means regular financial audits, public disclosure of operations, and strict compliance with international regulatory standards — all of which greatly reduce the risk of fraud or mismanagement.

4. Independent auditing and due diligence

Freedom24 is audited by Deloitte, one of the Big Four accounting firms, which regularly conducts independent financial reviews and due diligence. This further strengthens the platform’s credibility and trustworthiness in the eyes of investors and regulators.

Do you really own your investments with Freedom24?

Yes, and that’s an important distinction. With Freedom24, when you invest in ETFs, stocks, bonds, or options, you are purchasing real, underlying securities. This means you become the beneficial owner of the assets, not just a holder of derivative contracts or synthetic products, as is the case with CFDs, for instance, as explained here.

Why real ownership matters

Being the actual owner of your investments gives you several key advantages:

-

Transparency and security: Your holdings are registered in your name (or custody account), giving you full legal ownership and protection.

-

Portability: You can transfer your securities to another broker at any time. This is especially important for long-term investors who value flexibility and control over their assets.

-

Dividend and voting rights: As a shareholder of real assets, you’re entitled to receive dividends (where applicable) and may even have voting rights on corporate matters.

-

No counterparty risk from synthetic products: Some platforms offer only CFD-style instruments or synthetic ETFs, which expose users to counterparty risk. Freedom24 avoids this by offering direct access to real market assets.

Platforms & user experience

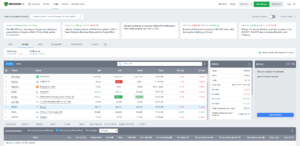

The Freedom24 web and mobile platforms are straightforward. You can track your portfolio, place orders, and consult basic research tools. While not as polished as some “app-first” brokers, it’s fully functional and intuitive. Advanced charting might be limited, but for most buy-and-hold or moderately active investors, it’s more than enough. Their “Trade” window looks like this (screenshot from my personal account):

Also, a dedicated “InvestIdeas” section provides fundamental analysis and commentary on markets, a neat extra for those who appreciate some guidance.

Education and market Insights

One of the standout features of Freedom24 is its strong focus on investor education and actionable market guidance, making it an appealing platform not just for seasoned investors, but also for beginners looking to learn and grow.

Freedom24 Academy: Learn at your own pace

The Freedom24 Academy is a dedicated educational hub offering free online courses on investing, tailored to various experience levels — from newcomers to more advanced traders. The content covers:

-

Basics of stock market investing

-

Understanding ETFs and bonds

-

Risk management and portfolio construction

Each course is presented in a clear, accessible format and designed to help users develop real-world investing skills. Whether you’re taking your first steps or looking to refine your strategy, the Academy provides a structured learning path.

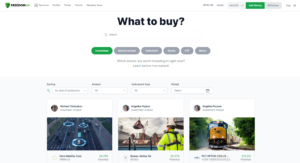

“What to Buy?” – Analyst-backed investment ideas

For investors seeking ongoing guidance, Freedom24’s “What to Buy?” section offers curated investment recommendations updated several times a week. These ideas are generated by the broker’s in-house team of market analysts and include:

-

High-potential ETFs, stocks, bonds, and options

-

Thematic picks and diversified strategies

-

Detailed justifications backed by market research

As of July 2025, Freedom24 reports an average cumulative return of 16% on its analyst-generated ideas:

Promotions and Freedom24 promo code

Freedom24 often offers promotions to attract new users. You might find a Freedom24 promo code granting free stocks. These promos vary, so it’s best to check their website or this broker bonus page to stay informed.

A Freedom24 bonus could be an excellent perk to test the platform’s features risk-free, especially for new investors curious to see how the service works.

Customer support & education

Freedom24’s customer service can be reached via chat, email, and phone. While not always offering native-language support for all EU countries, English support is generally responsive. There is also a robust FAQ section, educational content, and a blog with market analysis to help you become a more informed investor.

Final thoughts: Who is Freedom24 for?

Freedom24 shines as a comprehensive brokerage solution where you can diversify your portfolio globally. Its competitive fees, wide market access, and regulatory credibility make it attractive for intermediate investors. Beginners can also find value here, especially with the educational tools and occasional promos.

On the flip side, if you do a lot of cross-currency trades, hate withdrawal fees, or are deeply unsettled by past controversies, it might not be your top pick – make sure to check our list of the “Best European Brokers” to find an alternative.

Also, if you’re searching for more sophisticated instruments like CFDs or crypto (beyond ETFs), you’ll be disappointed.

In this Freedom24 review, we have seen that the broker is a noteworthy player in the European brokerage space.

Check their website and decide for yourself!

Hope we helped!

Disclaimer: Investing involves the risk of loss. Past performance does not guarantee future results. This Freedom24 review is for informational purposes only and does not constitute investment advice. Always do your own research and consider seeking advice from a certified professional if necessary.