Hello, fellow investor! This article is going to give you our unbiased review of the eToro platform for investing in the UAE & Dubai.

eToro is a popular broker known for its low fees and especially social trading feature. The latter allows the users to follow and copy the trades of other investors on the platform. It is overall an accessible and beginner-friendly broker, with an intuitive interface.

It also offers access to many of the most in-demand financial instruments, such as ETFs, stocks, and cryptocurrencies, along with CFDs on stocks, ETFs, commodities, currencies (Forex), indices, and cryptocurrencies. Commission-free trading is also available, but only for stocks and some ETFs.

In this article, we will take a closer look at the pros and cons of investing with eToro and other main factors to help you decide if eToro is the right platform for you.

What is eToro?

Founded in 2007 and having over 30 million users globally, eToro is a well-renowned broker. The platform is most known for its social trading feature, in which you can follow and copy other investors’ trades and portfolios. You can use eToro to invest in a large number of markets and financial products, which we will list below.

The platform is intuitive and well-suited even for beginners, also offering trading with virtual funds through its demo account. Account opening and making deposits are both easy and fast. Zero commission trading is available, and the minimum deposit is set at $50.

Some of the drawbacks include high spreads for some products, a $5 withdrawal fee, and only supporting one currency (USD). When depositing funds to eToro in AED the only payment method available is through a debit/credit card, and there is also a currency conversion fee which depends on the account tier level.

eToro pros and cons

Pros

👍 Wide selection of financial products

👍 Intuitive, easy-to-use, and beginner-friendly platform

👍 Low fees, including commission-free stock & ETF trading

👍 Many innovative features such as social trading (CopyTrader), Smart Portfolios, eToroMoney (only eToro Money Crypto Wallet is available in the UAE), eToro Club, etc.

👍 Regulated by various regulatory agencies

👍 Good customer reviews

👍 Educational articles and video courses are available (eToro’s Academy)

👍 Islamic (swap- and interest-free account) is available (min. deposit is $1,000)

Cons

👎 Only one currency is accepted for trading (USD)

👎 Withdrawal fee ($5)

👎 High spreads on certain products

👎 The platform has custody over crypto assets, which limits their control and security for the user

👎 Lacks some of the more advanced features for experienced traders

Fees

Low and transparent fees are one of the main pros of using of eToro. There are no fees for deposits, custody, account management, and when trading stocks. The most common fees are:

- Currency exchange fees when depositing in currencies other than the USD

- Fixed withdrawal fee of $5 (minimum withdrawal amount is $30)

- Market (bid/ask) spreads

You can find a quick fee summary in the following table:

|

Financial products |

Fees |

| Stocks | $0 + market spread |

| ETFs | $0 + market spread |

| Cryptocurrencies | 1% for both buying and selling |

| CFDs | Market spread + overnight fees |

| Withdrawal fee | $5 fixed fee |

| Inactivity fee | $10/month after 1 year of inactivity |

| Custody fee | $0 |

| Currency conversion | Between 50 and 150 PIPs |

As you can see, the fee structure is pretty straightforward, except for fees on CFDs which depend on the different market spreads and overnight fees (if applicable).

The currency exchange fee in practice means that for converting 10,000 AED you can expect to pay between 50 AED (50 PIPs) and 150 AED (150 PIPs).

You can find the official .pdf with the detailed fee structure here.

Markets and products

The platform offers access to a wide variety of financial markets and products. Most notably, you can invest in stocks, ETFs, and cryptocurrencies, as well as in CFDs on stocks, ETFs, commodities, currencies (Forex), indices, and cryptocurrencies.

Various markets are also available, including the US, European, and Asian stock markets. However, there is no access to futures or options markets.

You can see a quick summary table of all the financial products and markets on eToro:

| Financial product | Available? | Markets |

| Stocks | ✔ | US, Europe, UK, Australia, Hong Kong, Saudi Arabia |

| ETFs | ✔ | 300 ETFs from big companies: iShares, ProShares, Invesco, etc. |

| Cryptocurrencies | ✔ | 79 currencies |

| Forex | ✔ | CFDs on 49 currency pairs |

| Commodities | ✔ | 26 CFDs, including precious metals and crude oil |

| Indices | ✔ | CFDs in indices from the US, Europe, Japan, China, Hong Kong, Australia, Singapore |

| Futures | ✘ | N/A |

| Options | ✘ | N/A |

It is important to note that there is an option of an Islamic account with a minimum deposit of 1,000 USD. You can see more info about it here.

Social trading (Copy Trader)

The feature that eToro is best known for is probably its social trading feature named Copy Trader. It allows users to copy the trading behavior of other investors, both beginners and experienced. There is no additional charge for using this feature and also the copied trades are replicated in real time.

You can choose to follow only one trader or to spread your investments across up to 100 different traders. The traders that allow being copied earn a return as a percentage of profits, a fixed monthly fee, or other types of fees.

Copy Trader may be a simple way to start investing if you are new to the investing world. However, keep in mind that past performance is not an indicator of future results. There are also virtually no filters when choosing who to copy, with most investors on the platform being beginners.

Smart Portfolios

Another unique future of eToro is an automated investing tool named Smart Portfolios. Most Smart Portfolios are created and managed by the eToro Investment Team, whereas Partner Portfolios are created and managed by eToro’s partners, which include asset managers, data research companies, and more

Smart Portfolios are similar in a way to the Copy Trader feature because they allow beginner investors to start investing more easily.

There are 3 broad options to choose from:

- Innovative Thematic: portfolios focused on thematic investing in disruptive technologies.

- Top Trader: an investment strategy that is driven by the data of millions of users.

- Partner Portfolios: portfolios created by eToro partners such as WarrenBuffet-CF, CarlIcahn-CF, or Napoleon-X.

You can see the full list of Smart Portfolios here.

Smart portfolios start at $500 for the initial investment for Innovative Thematic and Top Trader portfolios and $5,000 for Partner Portfolios.

Additional fees are not charged for Smart Portfolios, but eToro’s market spreads do apply.

Safety and regulation

Being founded in 2007, regulated by top-tier financial institutions, and having over 30 million global users, eToro is considered a reputable broker. Most notably, eToro is authorized and regulated by the FCA (UK) and CySEC (Europe).

However, it is not licensed by the SEC (US) or the local UAE regulators (DFSA and ADGM) and does not operate a local UAE office.

As far as account security goes, eToro is offering modern security features such as 2-Factor Authentication (2FA) and biometric authentication (Face/Touch ID).

Platforms and tools

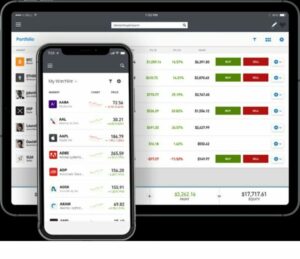

Both desktop and mobile applications that eToro is offering are visually clean and rather simple to use. The intuitive interface makes it easy even for beginners to start investing.

Both versions offer many features but may lack some more advanced features for experienced investors. Some of the features include:

- Virtual Portfolio (demo account)

- TipRanks Research Tab (information from expert investors)

- One-Click Trading (simplifying repeating trades)

- Different market orders (stop loss, take profit, and trailing stop loss)

- Pro Charts (technical analysis tool)

- Offline Trading (the ability to place orders 24/7)

The Virtual Portfolio (demo account) looks just like the real account but uses virtual money instead. It is a great option for anyone just getting familiar with the platform or investing in general. There is no time limit on the demo account and it is simple and easy to switch between the real and demo account anytime. You can read more about it here.

Account opening and funding

Opening an account on eToro is a simple and quick process. After following this link and clicking on the “Start Investing” button, the process is fairly straightforward.

One thing to keep in mind when opening the account is the choice between a demo account and a real account. You can of course have both opened simultaneously. Other required info is pretty standard, such as:

- Personal information

- Selecting a password

- Info about past investing experience and current financial situation

- Agreeing to eToro’s terms and conditions

- Copy of an ID and proof of residence

After the documents are verified, funding the account is simple and fee-free. However, keep in mind that eToro only uses USD currency to execute trades so you will be charged currency conversion fees (listed above) if depositing in another currency, such as AED. Also, while depositing funds is fee-free, fund withdrawal will incur a $5 fee.

Customer support and reviews

Customer support on eToro can be best reached in multiple ways:

- By opening a ticket on their Customer Service Center.

- Looking up the extensive FAQ section on their Help Center.

- Live chatting with a customer service representative (more info found here)

Customer support reviews are mixed, with most users claiming to have a very good experience, with others having a sub-par experience.

The community on eToro is also a good source of useful info. You can interact with other traders, ask questions, share ideas, and learn from others directly on the platform.

eToro also has a strong social media presence on Facebook, Twitter, Instagram, YouTube, and LinkedIn.

As far as customer reviews in general go, eToro has very good ratings overall. The users usually list the wide choice of financial products, innovative features such as social trading, and intuitive design as pros of the platforms. However, there are also some negative reviews, with the most common cons being relatively high fees or spreads for some products.

Some notable customer review sites for eToro:

- Trustpilot 4.3 stars on 19,000+ reviews

- Google Play 4.1 stars on 120,000+ reviews

Conclusion

To sum it all up, eToro is an innovative and modern platform that makes investing accessible to everyone. A wide variety of financial products, an intuitive platform, and low fees are some of the major reasons why the platform has amassed over 30 million users.

Innovative features such as social trading (Copy Trader), and automated portfolios (Smart Portfolios) along with the options of a demo account (Virtual Portfolio) and a free online academy (eToros’s Academy) are all alluring for beginner investors in particular.

That being said, eToro also offers some advanced features such as technical analysis tools and different market order types. All these features make it a good choice for beginner, intermediate, and most experienced investors.

Did we provide you with the necessary info to decide if eToro is the right choice for you? Let us know what you think about our review in the comments below!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.